What’s Up With All This Moo-Lah?

A focused look into our COWZ ETF Investment for 2022, Pacer Funds ETF – COWZ.

What Is COWZ?

COWZ is an exchange-traded-fund (ETF) from Pacer ETFs that is rebalanced quarterly based on the amount of free cash flow a company is yielding. Pacer will first screen the Russell 1000 Index (a stock market index that tracks the highest-ranking 1,000 stocks) for companies based off their free cash flow yield, then will narrow it down to the top 100 companies. From there, Pacer weighs the companies based off their free cash flow and selects them to be placed into their portfolio. One thing to note, Pacer caps the percentage a stock can make up the portfolio at 2%, so we are guaranteed diversification throughout the portfolio.

What is Free Cash Flow Yield and Why Is It Important?

Free cash flow is the cash remaining after a company has paid its expenses, interest, taxes, and long-term investments. With this cash, the company can buy back stocks, pay dividends, allocate more to research and development, or take part in mergers and acquisitions. Essentially, if a company is yielding a high free cash flow, they are healthy with strong balance sheets and are strategically placed to be selective about where to put their funds.

Looking Forward

In a rising interest rate environment where inflation is running rampant, investing in companies with strong financials and high free cash flow has proven to be beneficial. Past returns are no guarantee of future results, but with Pacer’s quarterly rebalance, we can be sure that companies that fall to the wayside are continually booted out of this ETF, therefore it keeps quality high and cash flow heavy.

Performance

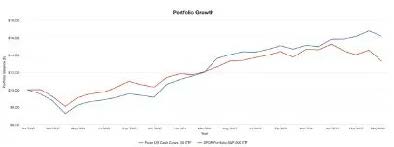

Above is a comparison of COWZ to the S&P 500 over the last 2 years (dated for the drop-in interest rates). We see that COWZ has an annual return of 22.91% compared to the S&P 500’s return of 12.95%. Due to the current economic conditions, we will be confident in this strategy for the next few quarters.

If you have any questions about your portfolio or your investment strategy, please don’t hesitate to reach out. As always, your money is in good hands, and we are continually monitoring this volatile market environment.