How Much Retirement Savings Should You Have?

It’s the question everyone eventually asks themselves. We all dream of the day we can enjoy the fruits of our labor. Unfortunately, there is no one-amount- fits-all answer. It depends on your lifestyle, how early you want to retire, how long you’ll be retired, etc. However, there’s plenty of research out there that’s helped us better calculate that figure.

By The Numbers

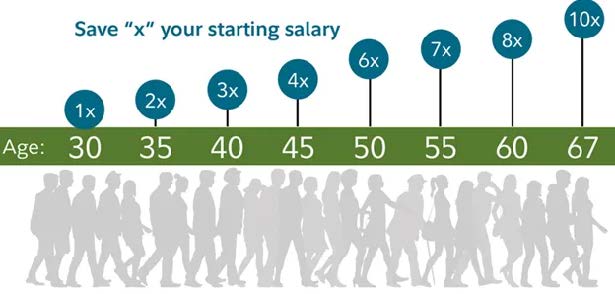

Analysis by Fidelity estimates that to maintain your current lifestyle, you should have saved 10x your pre retirement income, together with other steps, by age 67. This is based on the assumption that someone starts saving 15% of their income at age 25, invests over half that savings in stocks, and plans to live their pre retirement lifestyle.

This should give you a better idea of where you are at this point in your life and also indicate what you may have to do differently. Fidelity suggests saving at least 1x your income by 30 years old, 3x by 40, 6x by 50, and 8x by 60.

Your savings goals will vary depending on when you plan on retiring and how you want to live during retirement.

When You Plan on Retiring

The age you plan to retire at decides how much you’ll need to save. If you want to retire 2 years earlier at 65 years of age, you’ll have to save 12x your preretirement income to maintain your current lifestyle. If you retire at 70, you have to save 8x your retirement income. The longer you work, the less you have to save. Obviously, not everyone can work late into life due to job status and health. There are also those people that simply don’t want to work into their 70s. But one thing’s for certain, the longer you work, the less you’ll have to save. And that brings us to the other factor.

Your Lifestyle in Retirement

Not everyone expects to live the same lifestyle when they retire. You might, for example, plan to have fewer expenses. In that case, you might be able to retire at age 67 with only 8x of your preretirement income saved. Lots of people do this by downsizing their homes or spending less on expensive vacations. But if your dream is to vacation more and spend more, you might want to save 12x your preretirement income if you plan on retiring at 67. This is why it’s important to have a good idea of what you plan to do in retirement.

Other Factors to Consider

Everyone’s situation is different. Know your retirement number based on your financial needs. Everything depends on where your income at retirement is coming from. Do you have a pension, Social Security, passive income from real estate, are you downsizing, or moving to reduce your cost of living? The amount you need to save could be less based on some of these factors. The opposite is true as well.

Depending on your age and goals, you’ll want to learn how much you should save and how you should invest your savings. You may want to take more risks through stocks, or you may want to play it safe with cash and bonds. Either way, consult with your advisor to know what your savings amount should be and how to go about saving what you need. Need advice figuring it out? Contact IronOak Wealth today.